PI Futures: Don’t Cut Advertising in a Crisis

During his presentation at the recent PI Futures conference, hosted by Legal Futures, our head of marketing, Andy Cullwick, discussed the business impact of cutting your marketing spend.

He cited the experience of Coca-Cola, one of the world’s most recognised brands, which saw revenue slump by 11% - over $4bn – after cutting all above the line advertising during the pandemic. Worse still, it lost market share to rival Pepsi Co, which maintained its spend and saw sales soar.

Coca-Cola was not alone, however. Covid saw many firms, including some in legal services, pull their advertising as claims numbers fell.

The creation of the Official Injury Claim portal in 2021, a Ministry of Justice initiative aimed at reducing the number of whiplash cases, has also further impacted claims volumes.

But have these been two abnormal shocks to the market and are we set to return to business as usual, or were they a distraction to what was already a bigger challenge?

State of the market

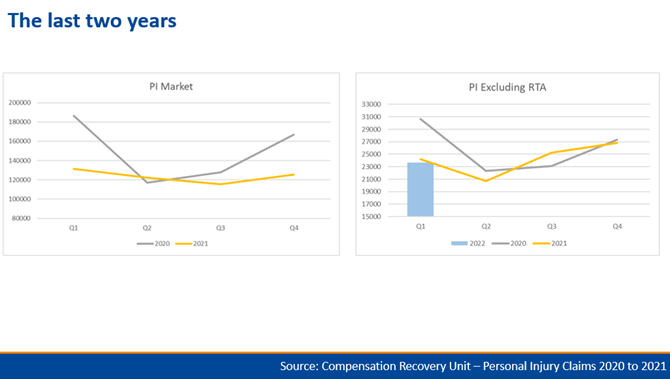

To understand the current state of the market, it is important to separate RTA and non-RTA claims. Taken together, the PI market appeared worse in 2021 compared to 2020, but reassuringly, the data we can see shows the non-RTA market had started to recover and was back on the increase by the end of last year.

This sentiment was also reflected in our recent state of the market survey which showed that 45% of firms expected the number of cases they were going to receive to increase this year.

But the market, particularly for RTA, has reduced in the last few years and while traffic has returned to normal post-pandemic, the number of claims has not.

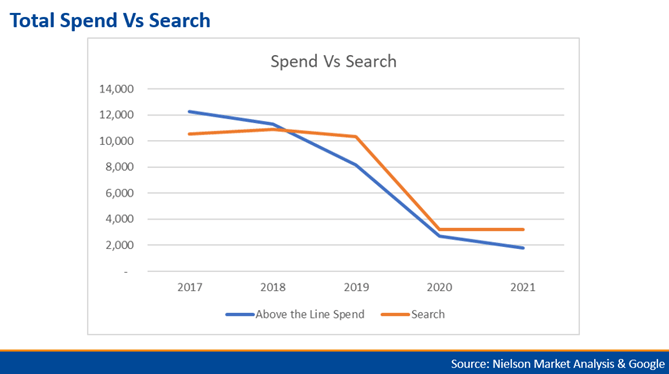

Furthermore, while numbers have fluctuated, data shows that consumer searches for personal injury terms are down by around a third compared not just to pre-pandemic numbers, but as far back as early 2017.

Is there simply less demand or could it be that we just aren’t marketing as much these days?

Spending habits

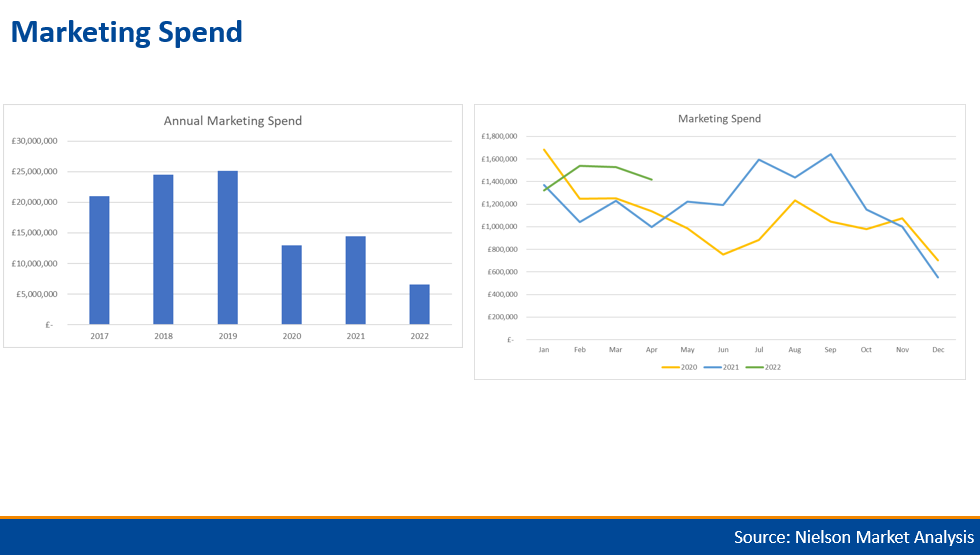

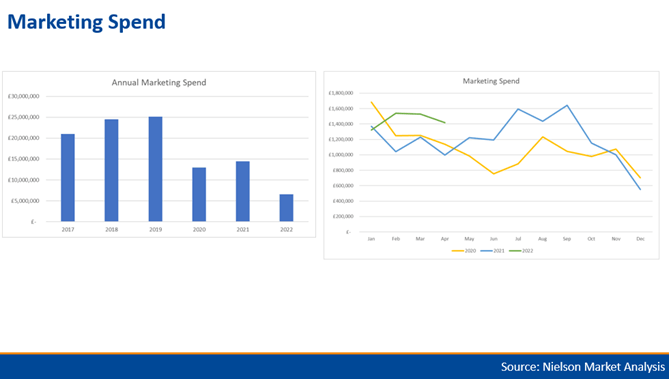

As an industry, we are spending less on marketing, but also how it is being spent is changing too.

Five years ago, almost 60% of marketing spend was on what we call ‘above the line’ activity - things like TV, radio, press and outdoor advertising. Since then, however there has been a significant decline and above the line now accounts for just 11%.

Digital is an easier channel to manage and at face value, can appear a more affordable and effective route to market. But online marketing activity is simply a response to people looking for support in making a claim and does little to raise awareness. Interestingly, there has been very little investment in this area in the last couple of years.

Search only works if you have awareness. If people don’t know about what you or the industry has to offer, then they are less likely to want to consume it.

Brand awareness

Many people will remember the PPI ads, in particular the disembodied head of Arnold Schwarzenegger reminding us to make a claim. During the 12 months leading up to the deadline, PPI firms spent a staggering £25m on above the line advertising alone.

The wider ‘compensation’ advertising across all marketing channels also more than doubled to four to five times more than what is being spent now, resulting in an increase in claims, not just for PPI but generally.

There is a a tangible correlation between consumer awareness, intent driven search and market size. But what we are seeing at the moment is a market reflective of low levels of consumer awareness (much of the criticism of the OIC portal is the lack of advertising, for example) but one where accidents will still be happening.

Furthermore, while cutting marketing spend is a short-term saving, research has shown that - on top of lost sales - for every £1 saved, firms will have to spend three times the amount to regain the lost ground in terms of brand awareness.

Conclusions

Above the line routes to market aren’t cheap and can be complex to manage and understand their effectiveness, but they do work.

A shrinking search market is only going to drive higher acquisition costs in the future and firms need to think about the bigger picture to ensure longer term sustainability. For example, look at what you can do through video, display and other channels.

As with everyone in the industry, we haven’t been immune to the challenges facing us and made the decision during Covid to up our marketing spend as well as widening our reach by broadening the channels we use, resulting in increased market share across some areas.

Online may look like an attractive proposition, but if you don’t remind consumers of what you do then you will see your potential audience dwindle.

Cutting advertising investment may look good on your bottom line in the short term but it can have cataclysmic consequences in the long run.

Quite simply, if you are looking to grow your business then don’t cut advertising in a crisis.